Kansas Sales Tax Calculator

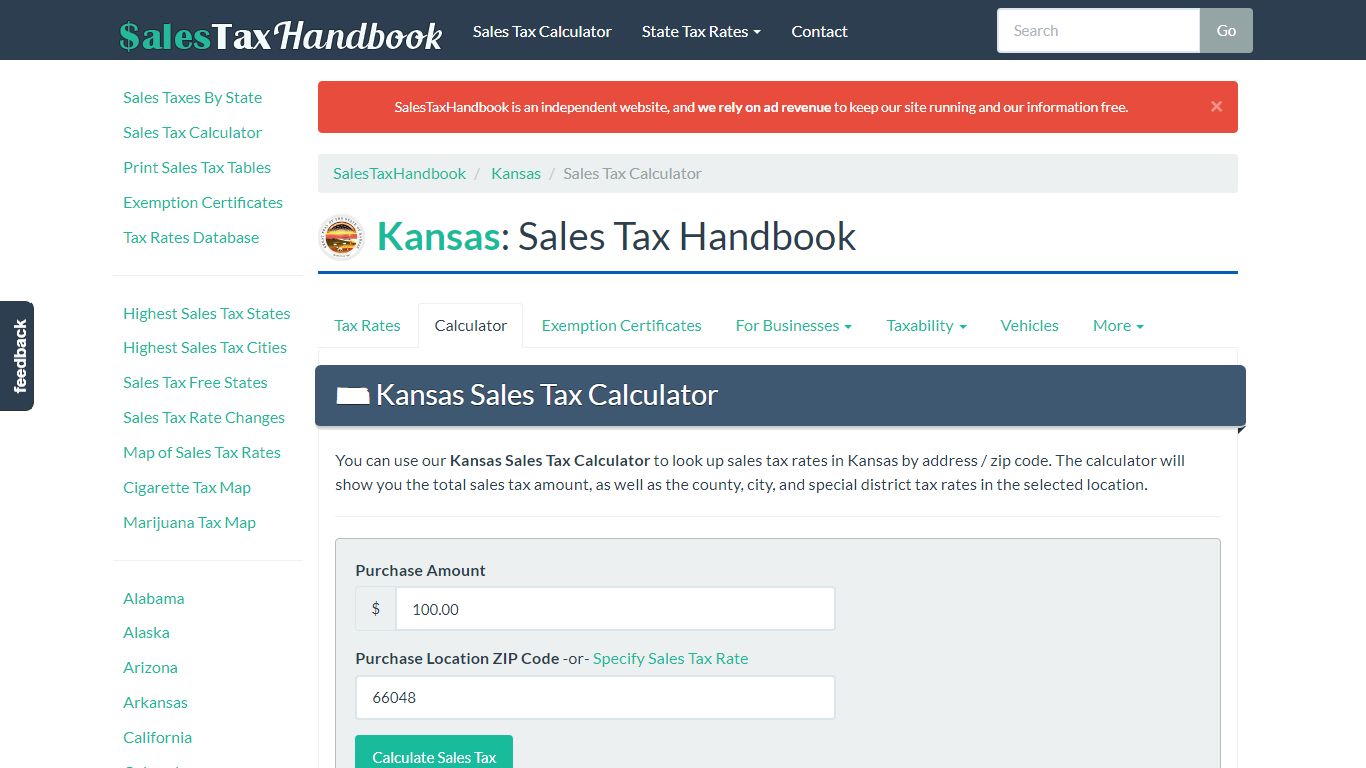

Kansas Sales Tax Calculator - SalesTaxHandbook

Kansas Sales Tax Calculator You can use our Kansas Sales Tax Calculator to look up sales tax rates in Kansas by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Purchase Amount $ Purchase Location ZIP Code -or- Specify Sales Tax Rate

https://www.salestaxhandbook.com/kansas/calculator

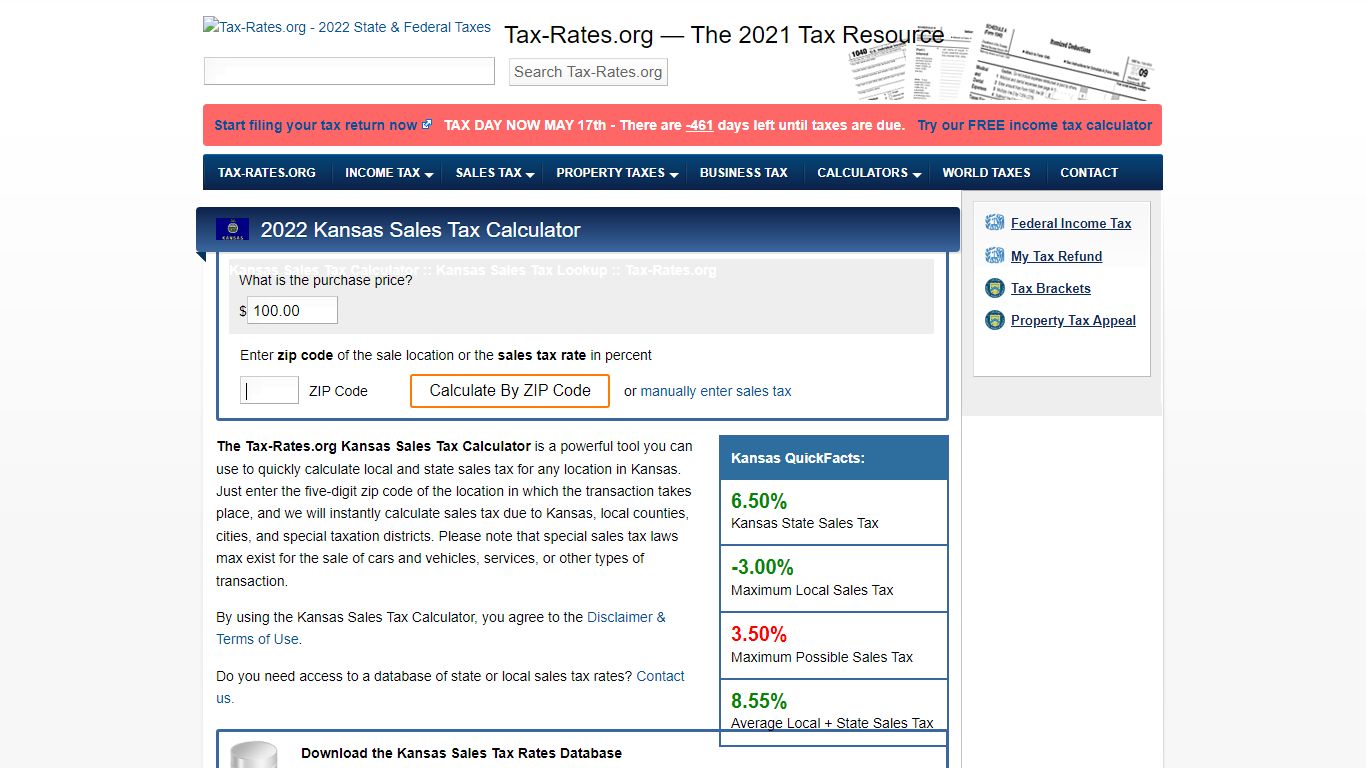

Kansas Sales Tax Calculator

Just enter the five-digit zip code of the location in which the transaction takes place, and we will instantly calculate sales tax due to Kansas, local counties, cities, and special taxation districts. Please note that special sales tax laws max exist for the sale of cars and vehicles, services, or other types of transaction.

https://www.tax-rates.org/kansas/sales-tax-calculator

Kansas Sales Tax Calculator - Tax-Rates.org

Just enter the five-digit zip code of the location in which the transaction takes place, and we will instantly calculate sales tax due to Kansas, local counties, cities, and special taxation districts. Please note that special sales tax laws max exist for the sale of cars and vehicles, services, or other types of transaction.

https://www.tax-rates.org/kansas/sales-tax-calculator?action=preload

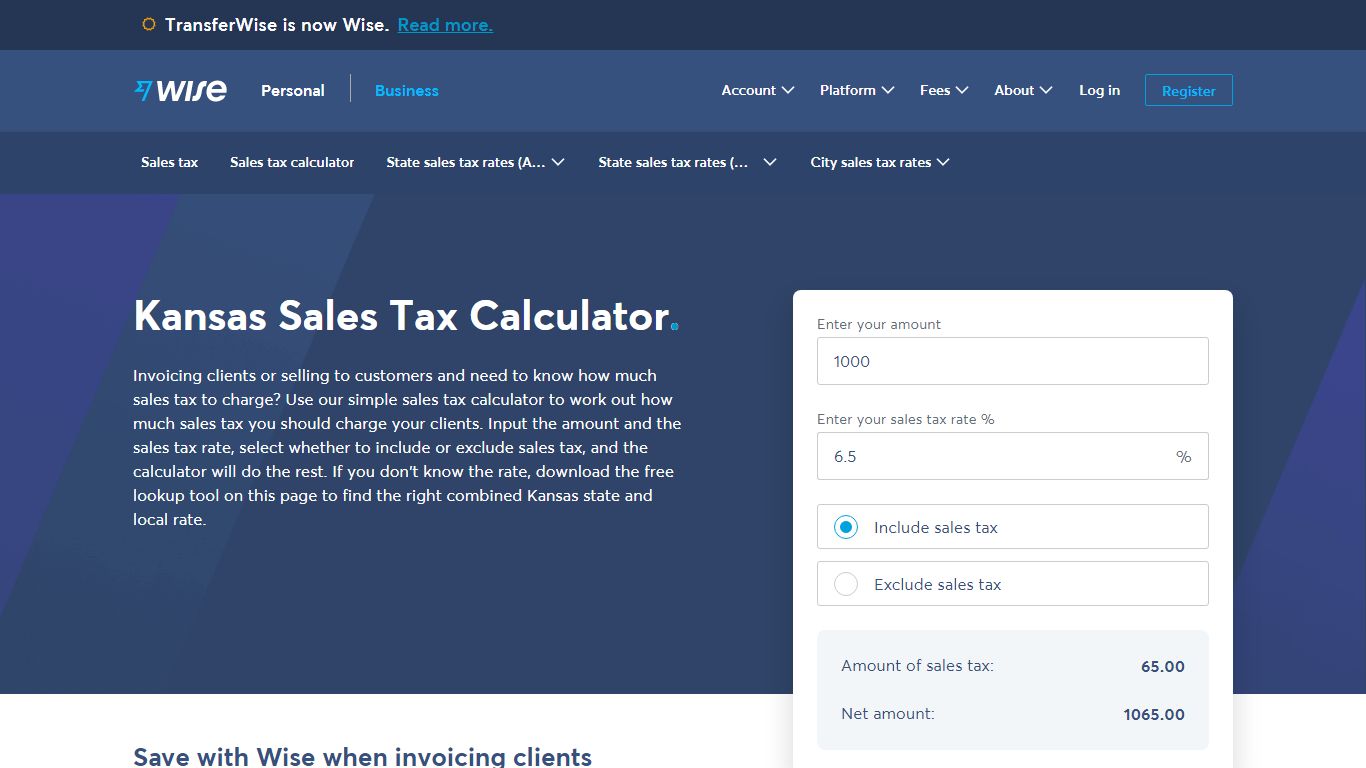

Kansas Sales Tax | Calculator and Local Rates | 2021 - Wise

The base state sales tax rate in Kansas is 6.5%. Local tax rates in Kansas range from 0% to 4.1%, making the sales tax range in Kansas 6.5% to 10.6%. Find your Kansas combined state and local tax rate. Kansas sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache.

https://wise.com/us/business/sales-tax/kansas

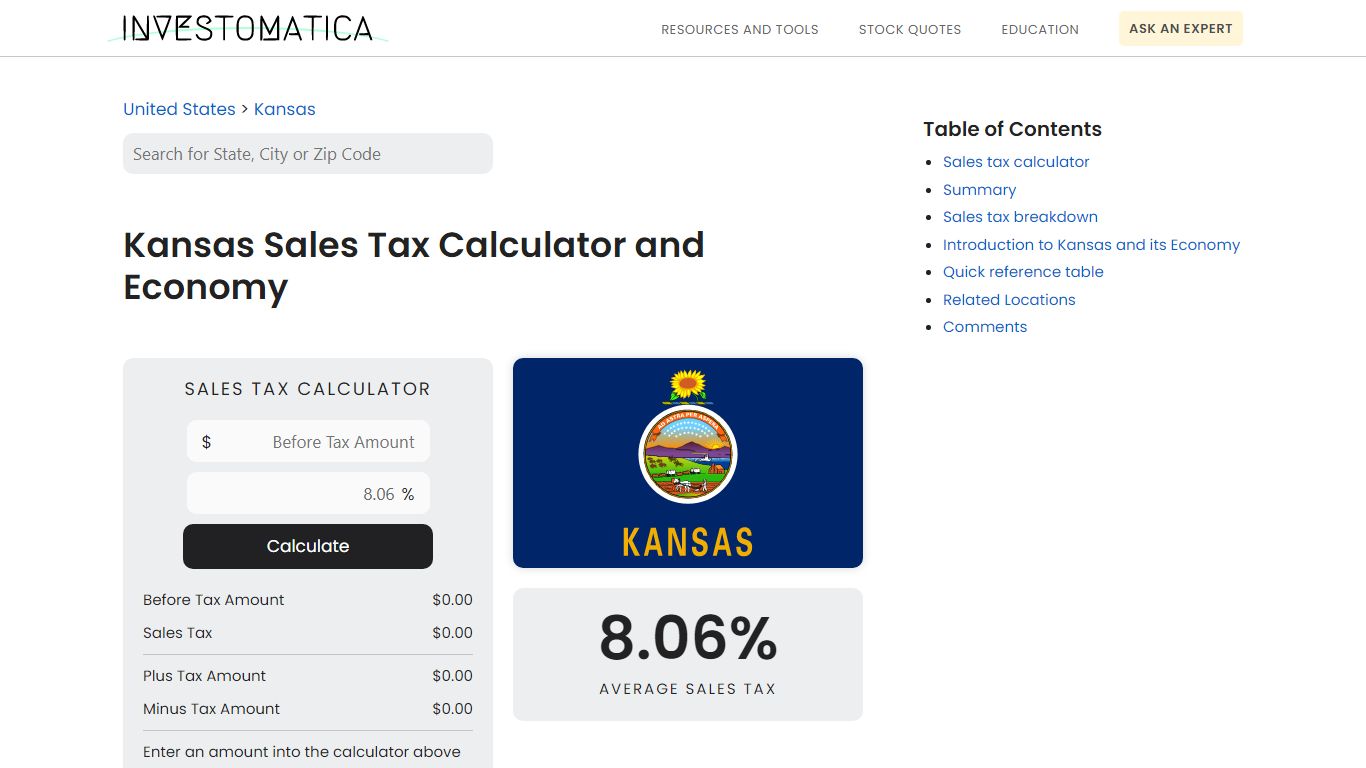

Kansas Sales Tax Calculator and Economy (2022) - Investomatica

Kansas Sales Tax Calculator and Economy Sales Tax Calculator Calculate Before Tax Amount $0.00 Sales Tax $0.00 Plus Tax Amount $0.00 Minus Tax Amount $0.00 Enter an amount into the calculator above to find out how what kind of sales tax you'll see in Kansas. You'll then get results that can help provide you a better idea of what to expect. 8.06%

https://investomatica.com/sales-tax/united-states/kansas

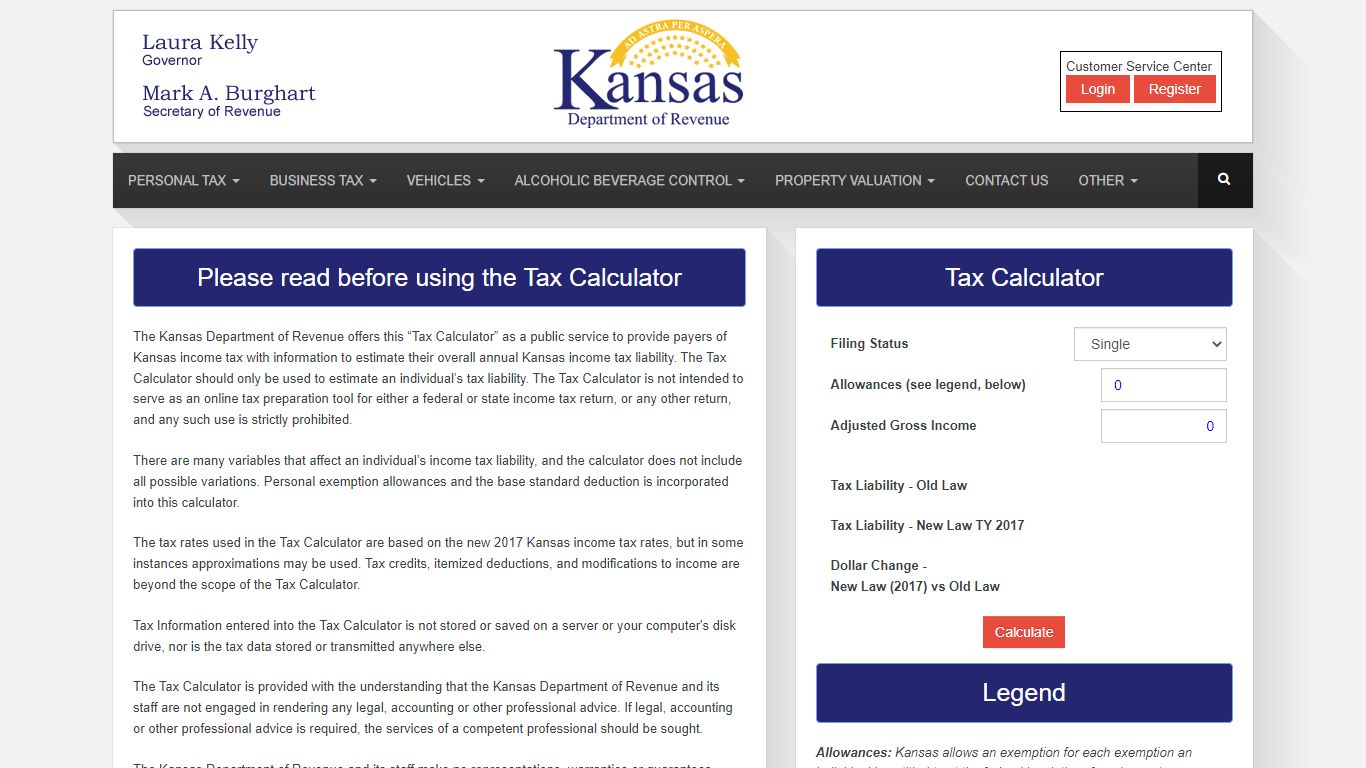

Kansas Department of Revenue - K60 Admin Home page

The Kansas Department of Revenue offers this “Tax Calculator” as a public service to provide payers of Kansas income tax with information to estimate their overall annual Kansas income tax liability. The Tax Calculator should only be used to estimate an individual’s tax liability.

https://www.kdor.ks.gov/Apps/taxcalculator

Kansas Sales Tax Rate & Rates Calculator - Avalara - US

Kansas state sales tax rate range 6.5-10.6% Base state sales tax rate 6.5% Local rate range 0%-4.1% Total rate range 6.5%-10.6% *Due to varying local sales tax rates, we strongly recommend using our calculator below for the most accurate rates. Download state rate tables Get a free download of average rates by ZIP code for each state you select.

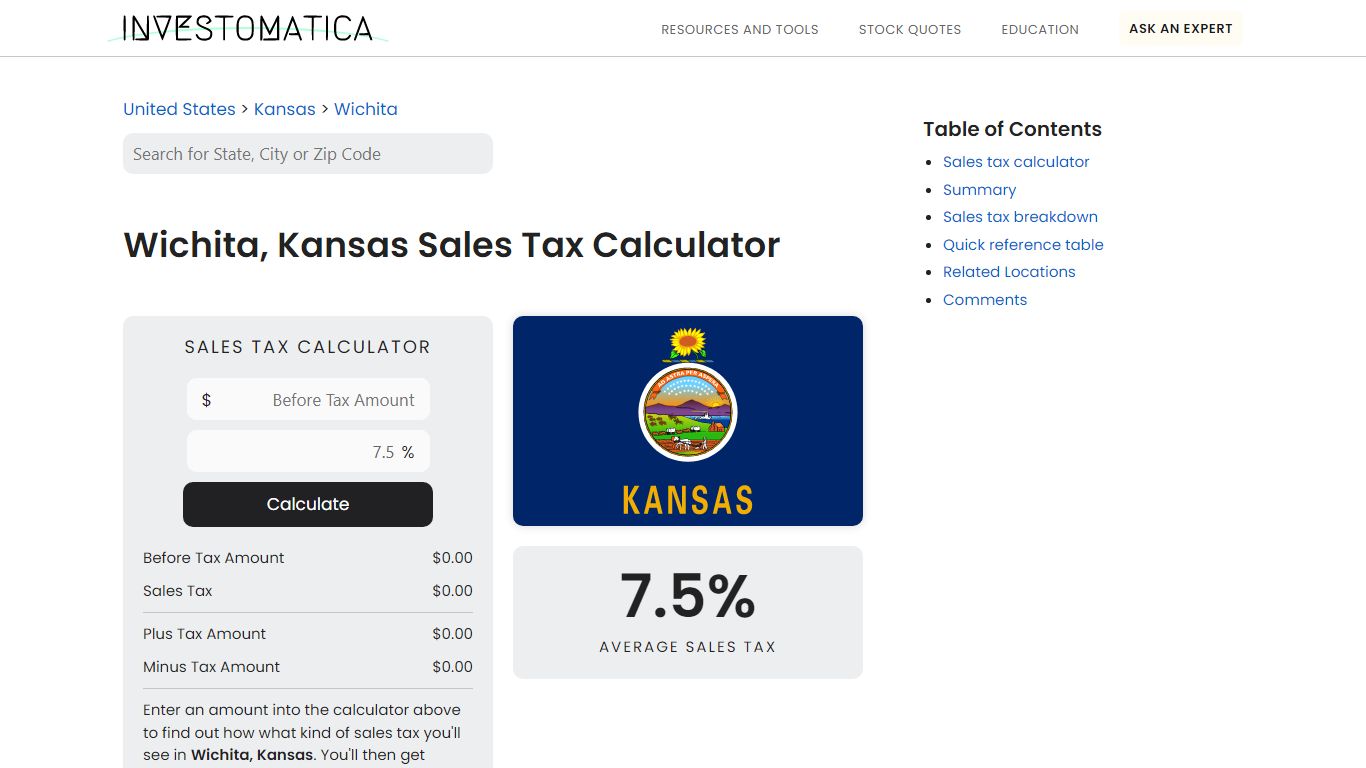

https://www.avalara.com/taxrates/en/state-rates/kansas.htmlWichita, Kansas Sales Tax Calculator (2022) - Investomatica

Sales Tax Calculator Before Tax Amount $0.00 Sales Tax $0.00 Plus Tax Amount $0.00 Minus Tax Amount $0.00 Enter an amount into the calculator above to find out how what kind of sales tax you'll see in Wichita, Kansas. You'll then get results that can help provide you a better idea of what to expect. 7.5% Average Sales Tax Summary

https://investomatica.com/sales-tax/united-states/kansas/wichita

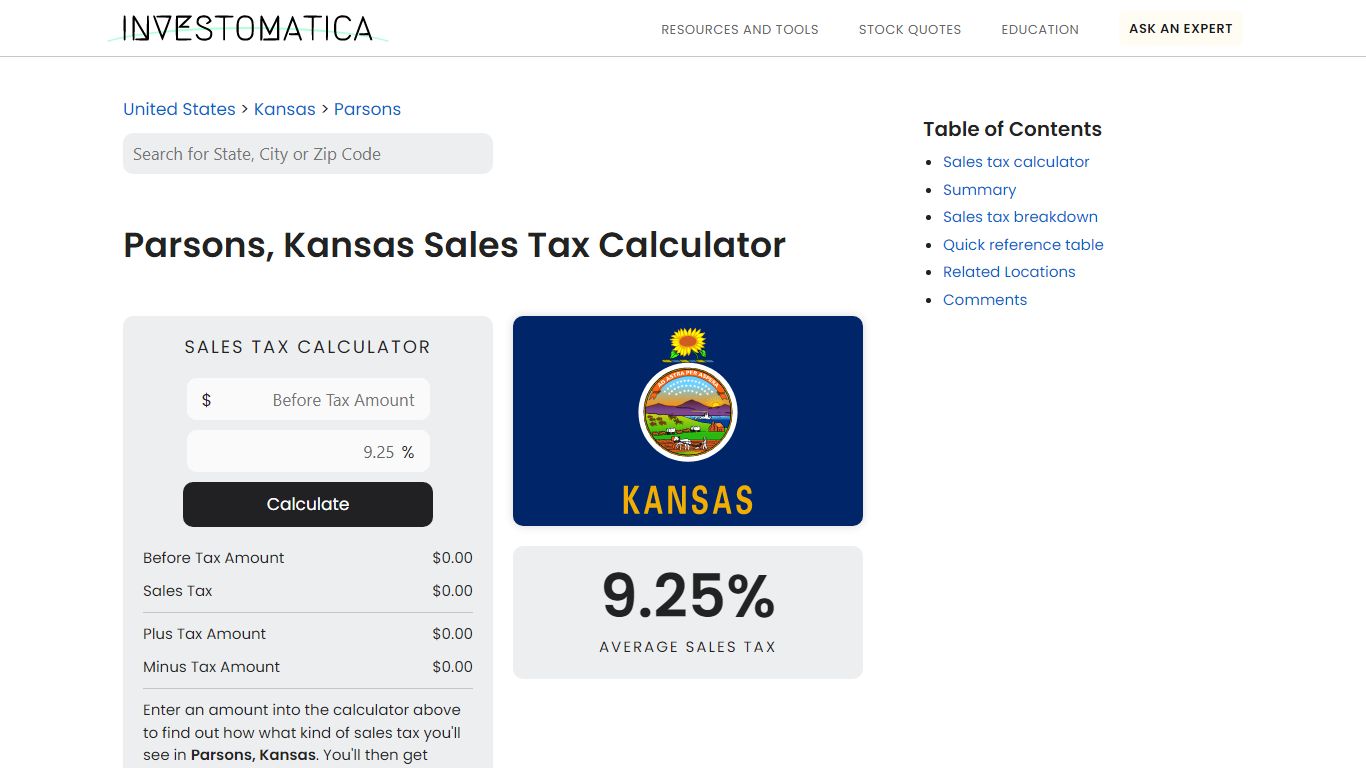

Parsons, Kansas Sales Tax Calculator (2022) - Investomatica

Enter an amount into the calculator above to find out how what kind of sales tax you'll see in Parsons, Kansas. You'll then get results that can help provide you a better idea of what to expect. 9.25% Average Sales Tax Summary The average cumulative sales tax rate in Parsons, Kansas is 9.25%.

https://investomatica.com/sales-tax/united-states/kansas/parsons

Kansas Department of Revenue Home Page

Burghart is a graduate of the University of Kansas. He earned his law degree in 1979 from the Washburn University School of Law and his Masters of Laws in Taxation degree from the University of Missouri at Kansas City in 1984. Secretary Burghart has more than 35 years of experience combined between private and public service in tax law.

https://ksrevenue.gov/